-

Latest Version

-

Operating System

Windows XP / Vista / Windows 7 / Windows 8 / Windows 10

-

User Rating

Click to vote -

Author / Product

-

Filename

setup.exe

-

MD5 Checksum

315663bf105e7efd7e364db60d610f52

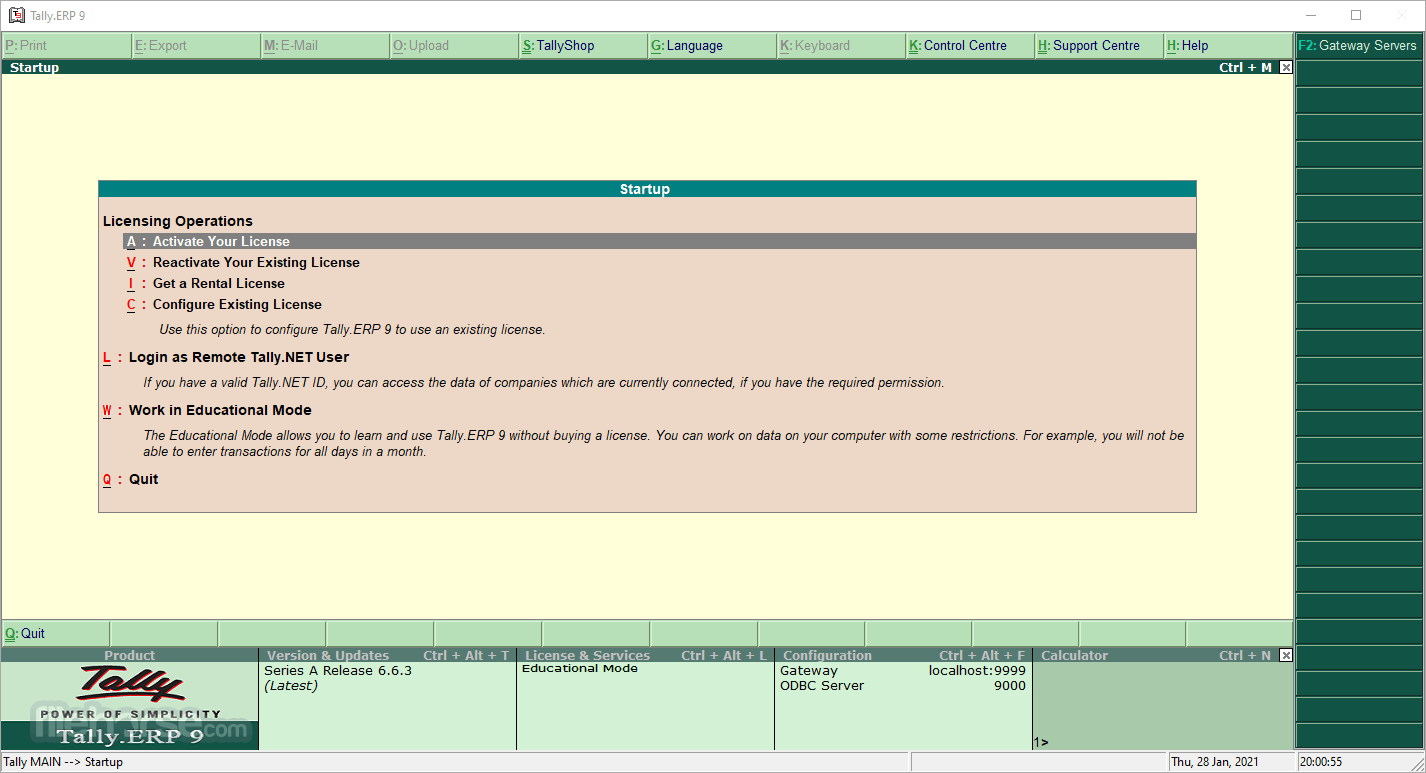

Sometimes latest versions of the software can cause issues when installed on older devices or devices running an older version of the operating system.

Software makers usually fix these issues but it can take them some time. What you can do in the meantime is to download and install an older version of Tally.ERP 9 6.6.2.

For those interested in downloading the most recent release of Tally.ERP or reading our review, simply click here.

All old versions distributed on our website are completely virus-free and available for download at no cost.

We would love to hear from you

If you have any questions or ideas that you want to share with us - head over to our Contact page and let us know. We value your feedback!

What's new in this version:

- Tally Reports in Browser: Now you can download reports and vouchers in the browser in MS Excel format

Improvements:

Accounts and Inventory:

- A warning message is shown when the Due date is lesser than the voucher date in sales orders

- The F7: Vouchers button was displaying a blank page in Trial Balance report. This issue is resolved

- The column title Account Name has been changed to Group Name in the Group Budget screen shown while creating Budgets for accounting group

GST:

- A provision is made to print invoice title as Tax Invoice when sales with both taxable and exempt/nil-rated goods is made to a registered dealer, and as Invoice-cum-Bill-of-Supply if the dealer is unregistered.

- Purchase from URD with value less than Rs. 5000 was appearing in GSTR-3B against From a supplier under composition scheme, exempt and nil rated supply under section 5. However, the transaction was not appearing on drilling down to the Voucher Register level. This was occurring when the option Enable tax liability on reverse charge (Purchase from unregistered dealer) was set to No. This issue is resolved.

- The purchase value appearing against d) Inward supplies (liable to reverse charge) in GSTR-3B does not match with the values shown when you drill down to Voucher Register level. This was occurring when:

- Purchase was recorded using journal voucher and the option Is reverse charge applicable? was enable under Tax Classification Details while recording the transaction.

- Purchase was recorded by selecting the fixed asset ledger with Nature of goods as Capital Goods

OperaOpera 125.0 Build 5729.49 (64-bit)

OperaOpera 125.0 Build 5729.49 (64-bit) MalwarebytesMalwarebytes Premium 5.4.5

MalwarebytesMalwarebytes Premium 5.4.5 PhotoshopAdobe Photoshop CC 2026 27.2 (64-bit)

PhotoshopAdobe Photoshop CC 2026 27.2 (64-bit) BlueStacksBlueStacks 10.42.153.1001

BlueStacksBlueStacks 10.42.153.1001 OKXOKX - Buy Bitcoin or Ethereum

OKXOKX - Buy Bitcoin or Ethereum Premiere ProAdobe Premiere Pro CC 2025 25.6.3

Premiere ProAdobe Premiere Pro CC 2025 25.6.3 PC RepairPC Repair Tool 2025

PC RepairPC Repair Tool 2025 Hero WarsHero Wars - Online Action Game

Hero WarsHero Wars - Online Action Game TradingViewTradingView - Trusted by 60 Million Traders

TradingViewTradingView - Trusted by 60 Million Traders Edraw AIEdraw AI - AI-Powered Visual Collaboration

Edraw AIEdraw AI - AI-Powered Visual Collaboration

Comments and User Reviews